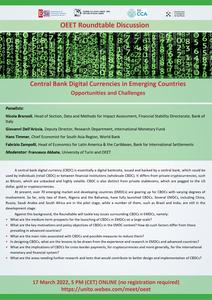

Central Bank Digital Currencies in Emerging Countries: Opportunities and Challenges (March 17, 2022)

Central Bank Digital Currencies in Emerging Countries: Opportunities and Challenges

OEET Roundtable Discussion

17 March 2022, 5 PM (CET) ONLINE (no registration required)

https://unito.webex.com/meet/oeet

Panelists:

- Nicola Branzoli, Head of Section, Data and Methods for Impact Assessment, Financial Stability Directorate, Bank of Italy

- Giovanni Dell’Ariccia, Deputy Director, Research Department, International Monetary Fund

- Hans Timmer, Chief Economist for South Asia Region, World Bank

- Fabrizio Zampolli, Head of Economics for Latin America & the Caribbean, Bank for International Settlements

Moderator: Francesco Abbate, University of Turin and OEET

ESt Dipartimento di Economia e Statistica "Cognetti de Martiis"

OEET Roundtable Discussion

A central bank digital currency (CBDC) is essentially a digital banknote, issued and backed by a central bank, which could be used by individuals (retail CBDC) or between financial institutions (wholesale CBDC). It differs from private cryptocurrencies, such as Bitcoin, which are unbacked and highly volatile. CBDC is also distinct from private stablecoins, which are pegged to the US dollar, gold or cryptocurrencies.

At present, over 70 emerging market and developing countries (EMDCs) are gearing up for CBDCs with varying degrees of involvement. So far, only two of them, Nigeria and the Bahamas, have fully launched CBDCs. Several EMDCs, including China, Russia, Saudi Arabia and South Africa are in the pilot stage, while a number of them, such as Brazil and India, are still in the development stage.

Against this background, the Roundtable will tackle key issues surrounding CBDCs in EMDCs, namely:

• What are the medium-term prospects for the launching of CBDCs in EMDCs on a large scale?

• What are the key motivations and policy objectives of CBDCs in the EMDC context? How do such factors differ from those

prevailing in advanced countries?

• What are the main risks associated with CBDCs and possible measures to reduce them?

• In designing CBDCs, what are the lessons to be drawn from the experience and research in EMDCs and advanced countries?

• What are the implications of CBDCs for cross-border payments, for cryptocurrencies and more generally, for the international

monetary and financial system?

• What are the areas needing further research and tests that would contribute to better design and implementation of CBDCs?